Pop

Latest about Pop

Al Pacino Has A Shrek-Themed Phone Case, And The Video Of Him Explaining It Makes Me Smile

By Lysa Rodriguez published

Al Pacino talks about his amazing phone case cover.

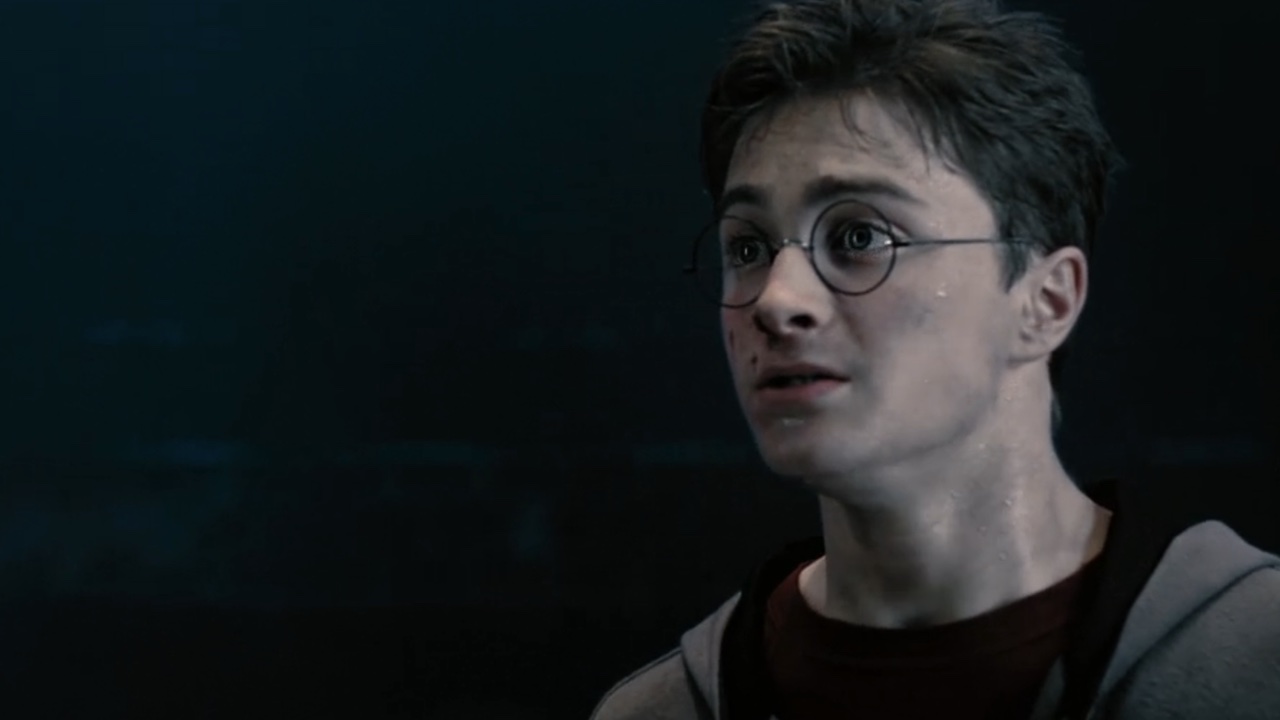

34 Major Challenges Harry Potter Had To Overcome

By Kelly West last updated

We're looking back at some of the major challenges Harry Potter had to face.

Kim Kardashian Reveals Her Positive Outlook After The Robbery In A New Post

By Nicholas Anthem last updated

Kim Kardashian And Kanye West May Have To Move In With Bruce And Kris Jenner

By Mack Rawden last updated

The Terrifying Scare Kim Kardashian Had During Her First Pregnancy

By Nicholas Anthem last updated

Kim Kardashian's pregnancies were scary experiences, but this story sounds like the most frightening moment of all.

Kim Kardashian Dropped A Great 90s Throwback Image Full Of Plaid

By Nicholas Anthem last updated

Kim Kardashian posted a '90s throwback photo and proved that she and Kourtney Kardashian have always been on trend. In fact, it's almost making us want to bust out all the plaid.

Kanye West And Drake Are Beefing Again, And Ariana Grande Has Weighed In

By Will Ashton last updated

Once again, Kanye West and Drake are beefing. The whole drama has spilled online, and Ariana Grande has a few things to say about the whole matter.

Your Daily Blend of Entertainment News