Disney Q1 2024 Earnings Call Live Blog: Taylor Swift, Moana 2, And More

It's been a rough quarter in the press for Disney, but here's how the financials are looking.

The last few months have been rough for Disney. The final months of 2023 included The Marvels underperforming at the box office, and 2024 has opened with Disney World being handed a significant loss in its lawsuit against Governor DeSantis. Of course, at the end of the day, what really matters to any publicly traded company is the stock price and what Wall Street has to say. Much of that will be determined by what Bob Iger has to say on the Q1 earnings call this afternoon.

Disney's stock price ended the day down slightly, closing at $99.27/share. Overall the earnings reported is coming in "better than expected." with earnings per share coming in at $1.22, though revenue came in at $23.55 billion versus an expectation of $23.64 billion. Disney+ subscribers shrank by 1.3 million, but revenue per subscription rose due to price increases.

We can expect the Disney Board of Directors to be a major topic of conversation as there are two different proxy fights, with different organizations fighting to get seats on the Board. The Annual Shareholders meeting is set for April.

Bob Iger is on CNBC right now ahead of the earnings call and has revealed Disney is taking a $1.5 billion stake in Epic Games and will be creating a Disney universe connected to Fortnite. The previously reported Moana animated series for Disney+ is being retooled as a feature film and is set to hit theaters in November

Disney's stock price has already seen an after hours bump following the release of the report and Bob Iger's interview. It has crossed the $99 mark, a lot of eyes are on the $100 threshold, a place Disney stock hasn't been since May of last year. Call should be starting very soon and we'll see what Iger has to say about the Moana and Epic Games announcements, as well as the new sports streaming package Disney is part of.

all is getting underway and Bob Iger opens it. Focus on Disney's plans to cut costs over the last year, says the last quarter is proof that has been successful. Mentions new sports streaming platform coming this fall. In Fall of 2025 ESPN will be available as a stand alone streaming option. Nick Saban will join as a commentator.

Iger mentions the Moana sequel, and the Epic Games stake. Calls it an "entertainment universe." Disney+ will also stream the Taylor Swift Eras Tour concert film.

Iger talks the future of ESPN, both as a standalone option, as well as part of the larger sports streaming platform. ESPN will be available as a bundle option for Disney+ subscribers.

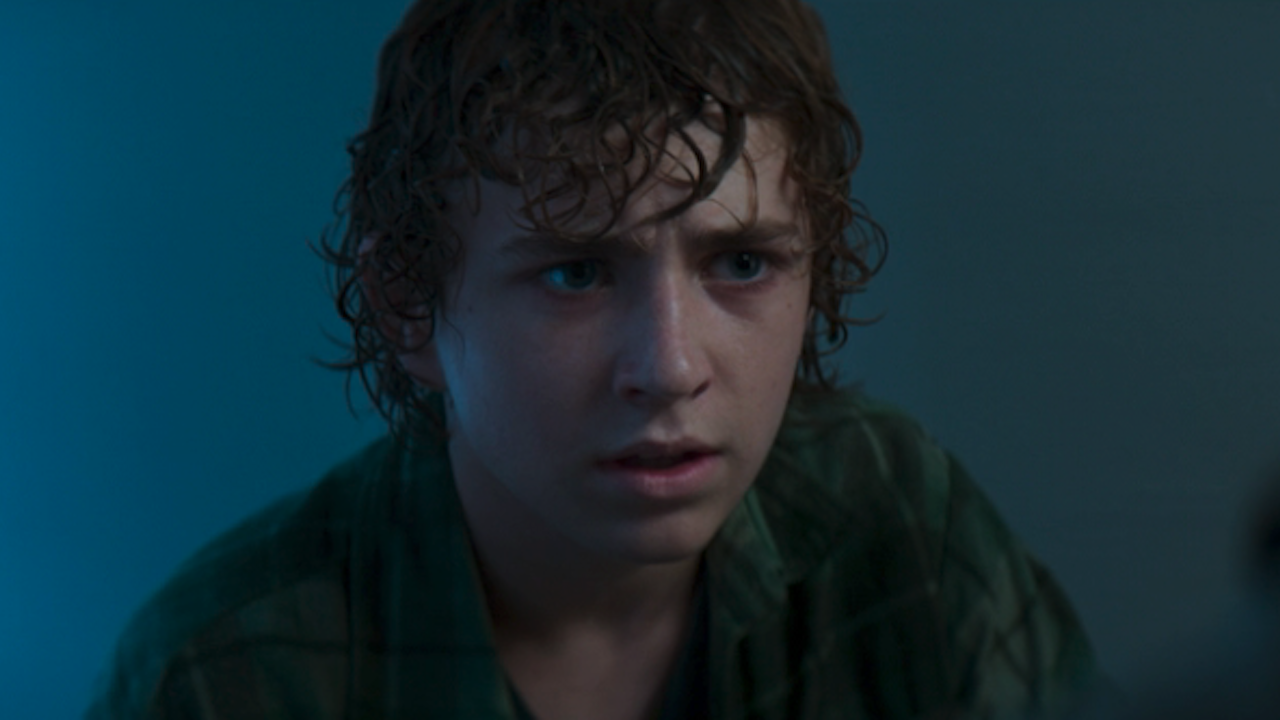

A second season of the Percy Jackson series on Disney+ has been officially confirmed.

Iger talks about the upcoming film slate. Says they were "impressed" with what they saw of the series, and knew it needed a theatrical release. Iger also mentions the original film's streaming success. Zootopia 2 is mentioned chronologically before Avatar 3, implying a Thanksgiving 2025 release.

All theme parks were profitable in Q1. This is a change from previous quarters. Domestic parks have been struggling more, with international parks largely keeping the division strong.

Iger talks about the Epic deal, implies this will allow a younger audience to bond with Disney characters and stories "where they are."

Disney planning $3B stock buy back program, which tends to boost stock price. a dividend is planned for July which will be 50% higher than the January dividend. Moving over to the CFO for the hard number talk.

Operating income across all segments grew.

With a shareholder proxy war on two fronts looming, Bob Iger has now dropped a series of bombshells. Sports fans, Disney fans, even video game fans, are likely to be very happy by all this news, and any of them that own stock will want to see all this come to fruition.

Moving into the Q&A, and there will likely be many. Morgan Stanley asks about sports. How is Disney thinking about all the new sports announcements, and what success looks like in sports.

Iger says says ESPN has continued to be strong, but is mindful of the future. Has always known moving ESPN to streaming was inevitable. Calls the future of sports options a "progression." Says as long as ESPN keeps dominance with fans, advertisers, leagues, it will be a success.

Next question from MoffettNathanson. Asks about Hulu Live, how it fits with sports feature, and growth targets. Iger says thinks sports feature will help Hulu Live, but is clearly focusing of Hulu itself, as it integrates with Disney+. Certainly sounds like Hulu Live isn't going to be a big focus going forward. Doesn't sound like Iger sees the "fat" bundles as the future.

BofA has the next question. Asks about the $60 billion in Parks spending that Iger has talked about. He said earlier 70% would be spent on "incremental expansion." Iger says they are hard at work determining where to spend money on expansion. Promises all parks, and Cruise Line, will see some of that focus. Iger says we'll see new things opening starting in 2025 and going forward, but won't talk specifics.

Wells Fargo asks about studio output, if Iger thinks it is turning a quarter, and when we'll start to see results. Iger says he feels "great" about the studio. Reiterates that volume was detrimental to quality, which he has said before. Calls out his partnerships with Studio/TV/ESPN. He calls out Inside Out 2, Mufasa, Deadpool 3, and the new Moana as movies he is confident in.

Next question asks Charter cable/Disney+ bundle, and if we might see more of that. Iger says its too early, though early numbers are encouraging. Iger thinks we will see the same arrangement with other multichannel services.

Last question: Asked why the Epic Games investement is the right move. Says licensing has been far more successful than other attempts to work with video games. Iger says younger generation spends so much time with games Disney has to be there. Disney's Fortnight experience has already been positive, idea of a "Disney World" in the game seemed right.

That's it for the call. Quite a series of announcements, that will likely boost the stock price as Disney enters into a trying couple of months prior to the Shareholders meeting.