Destiny Grosses $325 Million In Consumer Sales Within 5 Days

Your Daily Blend of Entertainment News

You are now subscribed

Your newsletter sign-up was successful

Previously it was reported that Activision had managed to sell-in to retailers an impressive $500 million worth of SKUs (stock keeping units), breaking even on their supposed $500 million dollar investment into the Destiny brand. Today, Activision has announced that the actual sell-through revenue of Destiny is only $325 million.

. Activision sent out word that within the first five days of being on the market, Chart-Track, first parties, retail consumer information for sell-through data and Activision's own internal estimates have put Destiny at $325 million in sell-through revenue.

Activision also logged data of more than 100 million hours of play-time put into the game within its first week on the market and more than 137 million activities having occurred within the online-oriented play-field. The press release was also keen to reiterate winning 180 awards prior to release, even though most of the review scores have been less than stellar.

Eric Hirshberg, CEO, Activision Publishing commented about the news, stating...

"Destiny fans played more than 100 million hours of the game in the first week. That's on par with the engagement levels of our most popular Call of Duty games, which obviously is an industry leader,""Millions of gamers are having a great time playing Destiny and can't put down their controllers. And this is just the beginning. Destiny is a platform that will grow and evolve and we will continue to work closely with our partners at Bungie to bring a long line of new experiences and content to life in the game."

It may not be all sunshine roses. Selling into retailers $500 million worth of SKUs and only moving $325 million within the first week doesn't quite add up. There's still $175 million worth of Destiny titles sitting around; and if those don't sell within a timely manner, then that break-even point of having shifted $500 million to retailers could become null if any of those copies have to be shipped back to Activision, or retailers fail to order more. This makes the next couple of weeks absolutely crucial, as far as sales go for the first-person shooter.

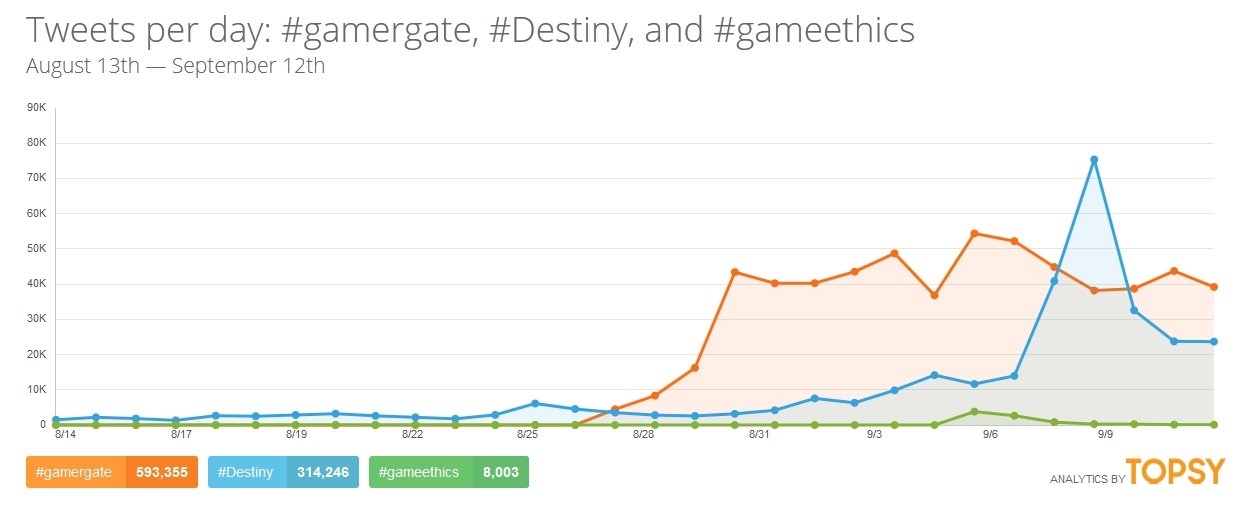

It probably didn't help that beyond September 8th, Destiny was over-shadowed on social media's Twitter by #GamerGate, potentially dampening its social market reach.

Funnily enough, the dip in social media praise, the middling reviews (including one from Gaming Blend's own Pete Haas) and the fact that the sell-through doesn't quite match up with the sell-in for first week sales, has actually caused Activision's stock to take a bit of a tumble, as evidenced on Marketwatch, going from just above $24 a share five days ago, down to $21.60 as of the writing of this article on September 17th, 2014.

Your Daily Blend of Entertainment News

The news swings wildly across the spectrum regarding Activision's announceme, as some sites, such as The Fly, are reporting that analysts from Piper Jaffray see the $325 milllion as a sure sign that Activision may be heading toward 10 million SKUs sold before the year is out. Other sites, such as 247WallSt.com, question if the whole thing is a financial disappointment.

Given the poor Metacritic rating, Bungie won't be receiving those extra payout bonuses as cited in their contract, but if the game does hit 10 million SKUs (or digital units) sold before the year is out, they'll likely continue to stay employed making more Destiny content under Activision's publishing wing.

Staff Writer at CinemaBlend.